Technology

Stifel Global Technology Group

A leading technology investment banking franchise offering a full suite of services dedicated to the middle market.

Offering a world-class combination of deep sector knowledge, strong industry relationships, and broad product expertise, our team provides clients with strategic advisory and capital-raising services designed to support growth companies and their investors during all stages of their development.

With more than 100 professionals working as an integrated team across North America and Europe, Stifel is one of the leading providers of capital-raising services to technology companies and technology-focused institutional investors.

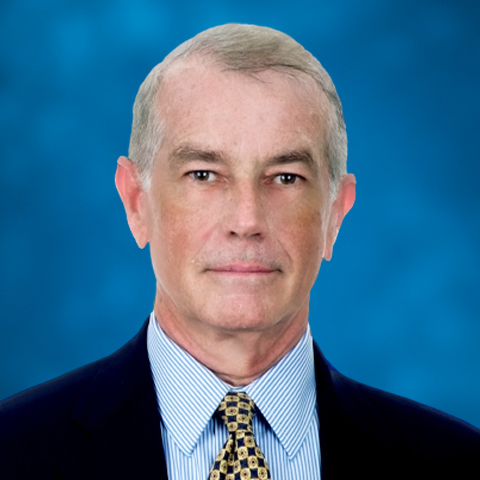

Stifel Announces Key Appointments to Global Technology Group Leadership Team

Learn MoreTechnology Subsector

The Global Technology Group’s Electronics & Industrial Technology team has a multi-decade track record advising public and private clients on mergers and acquisitions and capital-raising transactions. Our team brings deep domain expertise and far-reaching relationships in numerous segments, tracking and understanding the trends impacting clients in the rapidly evolving electronics, industrial, and infrastructure markets.

The Stifel Global Technology Group has a broad and extensive track record advising clients in the global internet and digital media ecosystem on strategic and financing initiatives, including M&A and capital fundraising. Some of our key team members have joined us with years of operating and investing experience in interactive media industries.

The Stifel Global Technology Group has a varied and extensive track record of success advising clients in the global media and telecommunications industries on countless strategic and financing initiatives, including M&A and capital fundraising. Several of our team members have joined us after years of operating and investing experience in the media and telecommunications industries, offering us unique in-depth industry insight.

The Stifel Global Technology Group’s Software team is one of the largest and most active investment banking teams in the world, with a proven track record supporting software clients across all major segments of the market landscape. Our bankers bring a unique perspective to software client engagements, drawing on deep relationships with most global software companies, private equity investors focused on growth software companies, venture investors supporting key innovation in software, and successful software entrepreneurs.

The Stifel Global Technology Group’s Tech-Enabled Services team has deep domain expertise advising clients on M&A and capital-raising transactions across industries including business process outsourcing, cloud infrastructure services, data and information services, HR and professional services, and IT services. Our team has extensive financing and M&A credentials and has executed a large number of domestic and cross-border transactions.

Notable Transactions

Mergers & Acquisitions

Software

Dec 2024

Initial Public Offering

Software

Dec 2024

Mergers & Acquisitions

Tech-Enabled Services

Nov 2024

Mergers & Acquisitions

Software

Nov 2024

Senior Secured Credit Facilities

Tech-Enabled Services

Oct 2024

Mergers & Acquisitions

Tech-Enabled Services

Oct 2024

Mergers & Acquisitions

Software

Sep 2024

Mergers & Acquisitions

Digital Assets

Jul 2024

Mergers & Acquisitions

Software

May 2024

Initial Public Offering

Internet & Digital Media

Jun 2024

Mergers & Acquisitions

Tech-Enabled Services

May 2024

Term Loan

Software

Mar 2024

Mergers & Acquisitions

Internet & Digital Media

Mar 2024

Mergers & Acquisitions

Tech-Enabled Services

Mar 2024

Follow-on Offering

Electronics & Industrial Technology

Mar 2024

Has Received an Investment

Software

Jan 2024

Mergers & Acquisitions

Tech-Enabled Services

Jan 2024

Mergers & Acquisitions

Software

Jan 2024

Mergers & Acquisitions

Tech-Enabled Services

Jan 2024

Mergers & Acquisitions

Media & Telecom

Dec 2023

Mergers & Acquisitions

Tech-Enabled Services

Dec 2023

Private Placement

Technology

Dec 2023

Senior Secured Term Loan

Tech-Enabled Services, Software

Dec 2023

Confidentially Marketed Follow-on Offering

Electronics & Industrial Technology

Dec 2023

Mergers & Acquisitions

Consumer, Technology

Nov 2023

Mergers & Acquisitions

Software

Oct 2023

Mergers & Acquisitions

Tech-Enabled Services

Sep 2023

Mergers & Acquisitions

Software

Sep 2023

Private Debt

Software

Sep 2023

Confidentially Marketed Follow-on

Software

Aug 2023

Mergers & Acquisitions

Tech-Enabled Services

Aug 2023

Mergers & Acquisitions

Internet & Digital Media

Aug 2023

Equity Placing

Technology

May 2023

Mergers & Acquisitions

Food & Beverage

Feb 2023

Mergers & Acquisitions

Electronics & Industrial Technology

Feb 2023

Mergers & Acquisitions

Media & Telecom

Feb 2023

Mergers & Acquisitions

Electronics & Industrial Technology

Jan 2023

Mergers & Acquisitions

Technology

Jan 2023

Confidentially Marketed Follow-on Offering

Electronics & Industrial Technology

Jan 2023

Has Sold Assets & Equipment

Technology

Dec 2022

Mergers & Acquisitions

Software

Aug 2022

Mergers & Acquisitions

Software

Aug 2022

Mergers & Acquisitions

Tech-Enabled Services

Nov 2022

Confidentially Marketed Follow-on Offering

Electronics & Industrial Technology

Nov 2022

Mergers & Acquisitions

Software

Nov 2022

Growth Investment

Software

Nov 2022

Placing and Subscription

Internet & Digital Media

Oct 2022

Mergers & Acquisitions

Software

Sep 2022

Mergers & Acquisitions

Software

Sep 2022

Mergers & Acquisitions

Software

Oct 2022

Senior Secured Notes

Software

Sep 2022

Senior Secured Credit Facilities

Software

Sep 2022

Senior Secured Credit Facilities

Software

Sep 2022

Follow-on Offering

Technology

Sep 2022

Mergers & Acquisitions

Software

Sep 2022

Mergers & Acquisitions

Electronics & Industrial Technology

Sep 2022

Mergers & Acquisitions

Tech-Enabled Services

Sep 2022

Mergers & Acquisitions

Software

Aug 2022

Mergers & Acquisitions

Software

Sep 2022

Mergers & Acquisitions

Electronics & Industrial Technology

Aug 2022

Mergers & Acquisitions

Internet & Digital Media

Aug 2022

Mergers & Accquisitions

Internet & Digital Media

Jul 2022

Block Trade

Technology

Jul 2022

Mergers & Acquisitions

Software

Jun 2022

Senior Secured Credit Facility

Tech-Enabled Services

Jun 2022

Mergers & Acquisitions

Tech-Enabled Services

Jun 2022

Mergers & Acquisitions

Software

Jun 2022

Follow-on Offering

Electronics & Industrial Technology

Nov 2020

Mergers & Acquisitions

Electronics & Industrial Technology

Apr 2022

Mergers & Acquisitions

Software

Dec 2021

Spin-off to

Software

Feb 2021

Mergers & Acquisitions

Software

Dec 2020

Follow-on Offering

Technology

Sep 2021

Mergers & Acquisitions

Electronics & Industrial Technology

Mar 2022

Mergers & Acquisitions

Electronics & Industrial Technology

Mar 2022

Mergers & Acquisitions

Internet & Digital Media

Feb 2022

Mergers & Acquisitions

Software

Feb 2022

Senior Notes

Software

Feb 2022

Mergers & Acquisitions

Internet & Digital Media

Feb 2022

Mergers & Acquisitions

Technology

Feb 2022

Initial Public Offering

Electronics & Industrial Technology

Jan 2022

Has Received a Minority Investment

Technology

Jan 2022

Private Placement

Technology

Jan 2022

PIPE

Electronics & Industrial Technology

Dec 2021

Mergers & Acquisitions

Electronics & Industrial Technology

Dec 2021

Follow-on Offering

Internet & Digital Media

Dec 2021

Mergers & Acquisitions

Electronics & Industrial Technology

Dec 2021

Technology

Nov 2021

Mergers & Acquisitions

Tech-Enabled Services

Nov 2021

Mergers & Acquisitions

Technology

Nov 2021

Mergers & Acquisitions

Electronics & Industrial Technology

Nov 2021

Follow-on Offering

Tech-Enabled Services

Nov 2021

Follow-on Offering

Electronics & Industrial Technology

Nov 2021

Private Placement

Technology

Nov 2021

Mergers & Acquisitions

Technology

Oct 2021

Initial Public Offering

Tech-Enabled Services

Oct 2021

Mergers & Acquisitions

Software

Oct 2021

Initial Public Offering

Electronics & Industrial Technology

Oct 2021

SPAC M&A

Electronics & Industrial Technology

Sep 2021

Mergers & Acquisitions

Internet & Digital Media

Sep 2021

Mergers & Acquisitions

Engineering & Construction, and Infrastructure

Sep 2021

Initial Public Offering

Tech-Enabled Services

Sep 2021

Mergers & Acquisitions

Internet & Digital Media, Software

Sep 2021

Mergers & Acquisitions

Electronics & Industrial Technology

Jul 2021

Mergers & Acquisitions

Electronics & Industrial Technology

Jul 2021

Minority Capitalization

Internet & Digital Media

Aug 2021

Mergers & Acquisitions

Software

Aug 2021

Initial Public Offering

Software

Jul 2021

Initial Public Offering

Internet & Digital Media

Jun 2021

Senior Secured Notes

Tech-Enabled Services

Jul 2021

Mergers & Acquisitions

Internet & Digital Media

Jun 2021

Mergers & Acquisition

Electronics & Industrial Technology

Jun 2021

Mergers & Acquisitions

Software

Jun 2021

Initial Public Offering

Internet & Digital Media

Jun 2021

Initial Public Offfering

Internet & Digital Media

Jun 2021

Mergers & Acquisitions

Software

Jun 2021

Confidentially Marketed Follow-on Offering

Electronics & Industrial Technology

Jun 2021

Mergers & Acquisitions

May 2021

Mergers & Acquisitions

HealthTech

May 2021

Divestiture of Assets

Electronics & Industrial Technology

May 2021

Senior Notes

Tech-Enabled Services

May 2021

Mergers & Acquisitions

Software

Apr 2021

Mergers & Acquisitions

Industrial Technology

Apr 2021

Mergers & Acquisitions

Software

Apr 2021

Mergers & Acquisitions

Tech-Enabled Services

Apr 2021

Mergers & Acquisitions

Software

Mar 2021

Follow-on Offering

Software

Mar 2021

Mergers & Acquisitions

Software

Mar 2021

Follow-on Offering

Electronics & Industrial Technology

Feb 2021

Initial Public Offering

Internet & Digital Media

Feb 2021

Initial Public Offering

Software

Feb 2021

Confidentially Marketed Follow-on Offering

Electronics & Industrial Technology

Feb 2021

Follow-on Offering

Electronics & Industrial Technology

Mar 2021

Initial Public Offering

Software

Feb 2021

Confidentially Marketed Follow-on Offering

Electronics & Industrial Technology

Jan 2021

Mergers & Acquisitions

Jan 2021

Follow-on Offering

Internet & Digital Media

Jan 2021

Confidentially Marketed Follow-on Offering

Electronics & Industrial Technology

Mar 2021

Follow-on Offering

Electronics & Industrial Technology

Mar 2021

Convertible Senior Notes

Internet & Digital Media

Mar 2021

Mergers & Acquisitions

Electronics & Industrial Technology

Jan 2021

Initial Public Offering

Internet & Digital Media

Jan 2021

Mergers & Acquisitions

Software

Oct 2020

PIPE

Electronics & Industrial Technology

Dec 2020

Fairness Opinion

Software

Dec 2020

Mergers & Acquisitions

Tech-Enabled Services

Dec 2020

Initial Public Offering

Software

Dec 2020

Mergers & Acquisitions

Internet & Digital Media

Dec 2020

Initial Public Offering

Software

Dec 2020

Mergers & Acquisitions

Electronics & Industrial Technology

Dec 2020

Senior Notes

Tech-Enabled Services

Oct 2020

Mergers & Acquisitions

Internet & Digital Media

Oct 2020

Mergers & Acquisitions

Internet & Digital Media

Nov 2020

Mergers & Acquisitions

Electronics & Industrial Technology

Dec 2020

Follow-on Offering

Internet & Digital Media

Sep 2020

Initial Public Offering

Software

Sep 2020

Senior Notes

Tech-Enabled Services

Sep 2020

Initial Public Offering

Internet & Digital Media

Jun 2020

Senior Notes

Media & Telecom

Jul 2020

Initial Public Offering

Electronics & Industrial Technology

Jul 2020

Follow-on Offering

Software

Jul 2020

Mergers & Acquisitions

Software

Apr 2020

Follow-on Offering

Software

May 2020

Follow-on Offering

Tech-Enabled Services

Jun 2020

Senior Secured Credit Facility

Tech-Enabled Services

Jan 2020

Currency volume represents full credit to each underwriter. All transaction announcements appear as a matter of record only. Stifel collectively refers to Stifel, Nicolaus & Company, Incorporated and other affiliated broker-dealer subsidiaries of Stifel Financial Corp.